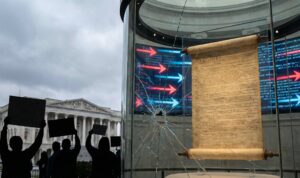

Continuing down the rabbit hole of suspicious activities. We will delve into the litmus test of all chaos and uncertainty, especially surrounding systems and politics….. follow the mighty dollar. Today, we are going to look into the financial moves that were made just prior to one of the most explosive political event in recent history, strangely akin to the most epic of all modern history, in 1963.

The events of July 13th, 2024, will forever be etched in history, not just for the assassination attempt on President Donald Trump, but for the shadowy financial maneuvers that occurred the day prior. On July 12th, Austin Private Wealth, LLC, a Texas-based investment firm, shorted a jaw-dropping 12 million shares of Trump’s Truth Social stock. The move, unprecedented in its scale and timing, has drawn intense scrutiny and speculation of a broader conspiracy involving some of the most influential names in finance and politics.

Short Selling: A High-Stakes Gamble

To understand the gravity of this situation, it’s crucial to comprehend what shorting a stock entails. Short selling involves borrowing shares and selling them at the current market price, betting that the stock price will fall. The short seller aims to repurchase the shares at a lower price, return them to the lender, and pocket the difference. This high-risk strategy is typically employed by investors who anticipate a decline in the stock’s value.

The Players and Their Associations

Austin Private Wealth, LLC: The key player in this scandal, Austin Private Wealth, LLC, executed the largest short position in its history, shorting 12 million shares of Truth Social stock. The firm later claimed this was due to a clerical error, adjusting their filing to show only 1,200 shares shorted. However, the timing and scale of the initial position suggest otherwise.

Citadel: Another significant firm, Citadel, shorted 16,770 shares of Trump’s stock on May 31, 2024. While smaller in scale compared to Austin Private Wealth’s position, Citadel’s involvement adds another layer of complexity to the unfolding drama.

Associations and Influential Figures: Austin Private Wealth is linked to powerful entities and individuals, including:

- BlackRock: One of the largest asset management firms globally, with significant influence over various financial markets.

- Vanguard: Another massive asset manager, often found in tandem with BlackRock in major financial dealings.

- George Bush: The Bush family’s political clout and financial connections raise questions about potential behind-the-scenes influence.

- George Soros: Known for his significant financial moves and political influence, Soros’s association with the firm adds fuel to conspiracy theories.

The Conspiracy and Potential Benefits

The sheer audacity of shorting 12 million shares of Truth Social stock just before an assassination attempt on its most prominent figure cannot be overlooked. The potential benefits for those involved are substantial. If Trump’s assassination had succeeded, the resulting chaos and uncertainty would likely have caused Truth Social’s stock to plummet, allowing those who shorted the stock to buy it back at significantly lower prices, reaping enormous profits.

The Aftermath and Lost Bet

Following the failed assassination attempt, the financial maneuver has not only drawn public ire but also regulatory scrutiny. The Securities and Exchange Commission (SEC) is investigating the short-selling activities to determine if insider information influenced these trades, which would be a severe violation of securities laws.

Austin Private Wealth’s claim of an administrative error has been met with skepticism. The firm’s unprecedented ability to reverse such a significant financial bet raises questions about regulatory oversight and the integrity of financial markets. The amended filing, reducing the short position from 12 million to 1,200 shares, seems more like an attempt to mitigate damage than a genuine clerical correction.

The Call for Accountability

The actions of Austin Private Wealth, Citadel, and their associated entities highlight the need for transparency and accountability in financial markets. The potential use of insider information, coupled with the connections to influential political and financial figures, points to a broader conspiracy that demands thorough investigation.

Conclusion

The events of July 12th and 13th, 2024, have cast a long shadow over both the financial and political landscapes. The combination of a high-profile assassination attempt and suspicious financial maneuvers suggests a scandal of significant proportions. As the investigation unfolds, the public and regulators alike must ensure that those involved are held accountable, restoring trust and integrity to the financial system.

This circus is ongoing and somehow Trump continues to exude leadership and grace. The clear and present danger is not even being covered anymore. We are in very trying and uncertain times. Let us take the high road as shown so elequantly by a man of leadership, regardless of personal feelings or issues with the man himself. Remember the lesson we gained from the events of July 13th, 2024. “Fight, Fight, Fight!!”